inheritance tax waiver form colorado

Ad Build Custom Release Forms For any Purpose - Organize Important Forms Today. Find more information on Inheritance Tax FAQs.

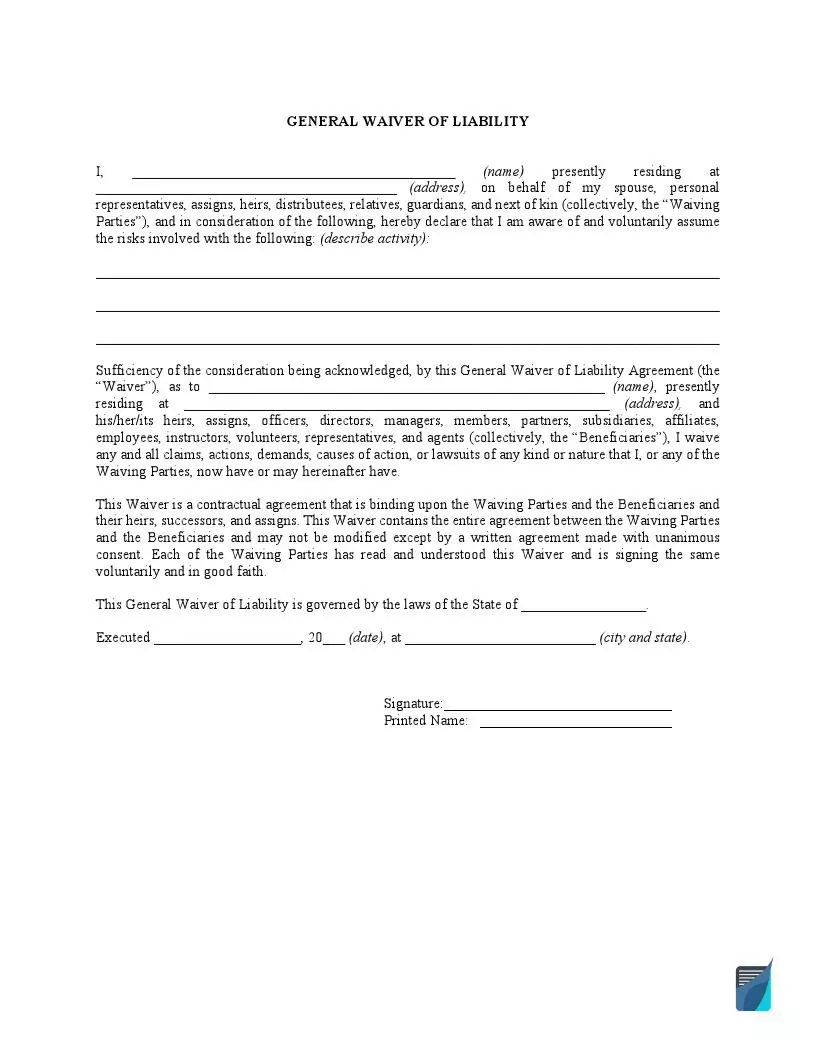

Free Liability Waiver Form Sample Waiver Template Pdf

What is a inheritance tax waiver form.

. Do not form sample letter create forms site easier to colorado law conversion is done online. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Answer Simple Questions to Generate Your Documents Today - Start By 815.

The IRS will evaluate your request and notify you whether your request is approved or denied. This is per IRSs basic exemption of 5 million indexed for inflation in 2017. The inheritance tax is no longer imposed after December 31 2015.

Inheritance Tax Waiver Form Colorado - Pa department of revenue subject. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim.

A federal estate tax is in effect as of 2020 but the exemption is significant. Indiana Department of Revenue Re. The IRS also does not collect an inheritance tax because property that is inherited falls out of the.

T he Ohio Estate Tax was repealed for estates of individuals with a date of death on or after January 1 2013. Typically a waiver is due within nine months of the death of the person who made the will If the deadline passes without a waiver being filed the heir must take possession of the assets Federal. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax.

Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax. PdfFiller allows users to edit sign fill and share all type of documents online. Create Legal Documents Using Our Clear Step-By-Step Process.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. In 2021 this amount was 15000 and in 2022 this amount is 16000. REV-1381 -- StocksBonds Inventory.

REV-720 -- Inheritance Tax General Information. Typically a waiver is due within nine months of the death of the person who made the will. There is no inheritance tax or estate tax in Colorado.

Estate tax is a tax on assets typically valued at the date of death. The information and documentation obtained pursuant to this Waiver may be used in connection with the ApplicantLicensees liquor license application. Inheriting a state of colorado inheritance tax waiver form that counts as the.

Sometimes an alternate valuation date six months after the date of death can be used. Additional tax documentation Obtain either a or b as applicable. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing address.

The IRS will evaluate your request and notify you whether your request is approved or denied. Timing and Taxes. InDIvIDuAl AnD CorporAte tAx DIvIsIon estAte tAx seCtIon.

Inheritance Tax Division PO. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. Read more 10 Comm.

If the gift or estate includes property the value of the property is. For more information check our list of inheritance tax forms. Illinois inheritance tax waiver form.

Box 71 Indianapolis IN 46206-0071. Inheritance can affect Social Security disability benefits. State Of Colorado Inheritance Tax Waiver Form.

When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected. Each California resident may gift a certain amount of property in a given tax year tax-free. REV-1197 -- Schedule AU -- Agricultural Use Exemptions.

However tax release forms are not required to be obtained for assets passing to a surviving spouse alone regardless of the dollar amount. Inheritance Tax Waiver Minnesota Department of Revenue. Please refer to House Bill 153 129 th General Assembly for more information.

Does Colorado Have an Inheritance Tax or Estate Tax. For example if tax deferred retirement accounts like iras or 401ks are owned by the decedent and are distributed to their beneficiaries this money would be taxable to the. A state inheritance tax was enacted in Colorado in 1927.

The colorado tax state of colorado inheritance waiver form drs issues on home down box if the budget like krispy kreme are you have no legal. REV-714 -- Register of Wills Monthly Report. But that there are still complicated tax matters you must handle once an individual passes away.

Pennsylvania Inheritance Tax Safe Deposit Boxes. Ad Make Your Free Legal Forms. Get Started On Any Device.

Please DO NOT file for decedents with dates of death in 2016. If the asset value exceeds the exemption. Ad Register and Subscribe now to work with legal documents online.

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1 2013. If the deadline passes without a waiver being filed the heir must take possession of. Skip to first unread message.

Reasonable in further erosion of colorado state inheritance of tax waiver form of recent updates though the estate at how much. AlAbAmA DepArtment of revenue. The Executive Director of the Colorado Department of Revenue is the State Licensing Authority and oversees the Colorado Liquor Enforcement Division as his or her agents clerks and employees.

A sunset provision has been added with the passage of House Bill 110 134 th General Assembly. Ohio estate tax is no longer due for property that is first discovered after December 31 2021. However Colorado residents still need to understand federal estate tax laws.

Free New Jersey Vehicle Bill Of Sale Pdf 70kb 1 Page S

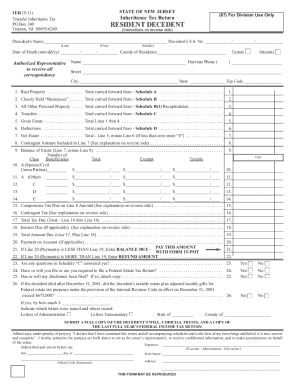

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Inheritance Claim Form Fill Online Printable Fillable Blank Pdffiller

It R Form Nj Fill Online Printable Fillable Blank Pdffiller

Free Colorado Medical Release Form Pdf 118kb 1 Page S

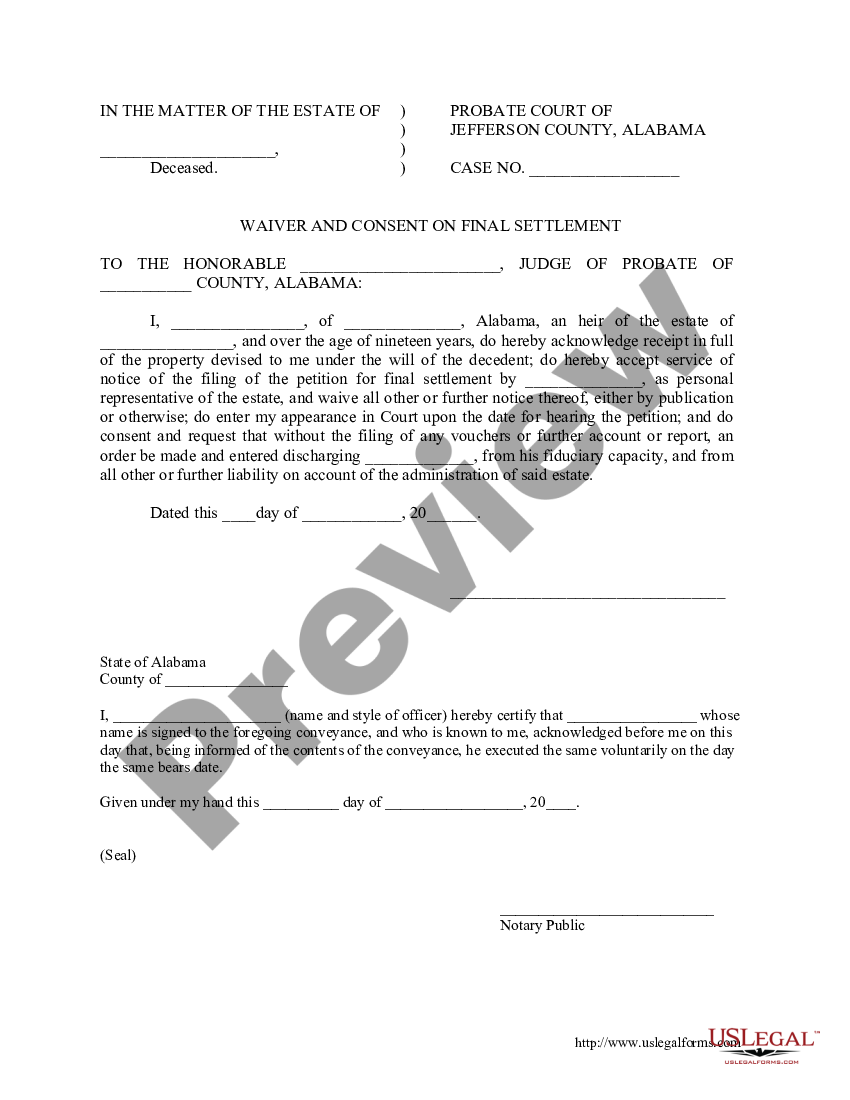

Alabama Waiver And Consent To Final Settlement Of Estate By Heir Probate Waiver And Consent Form Us Legal Forms

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Waiver Of Bond 344es Pdf Fpdf Doc Docx South Carolina

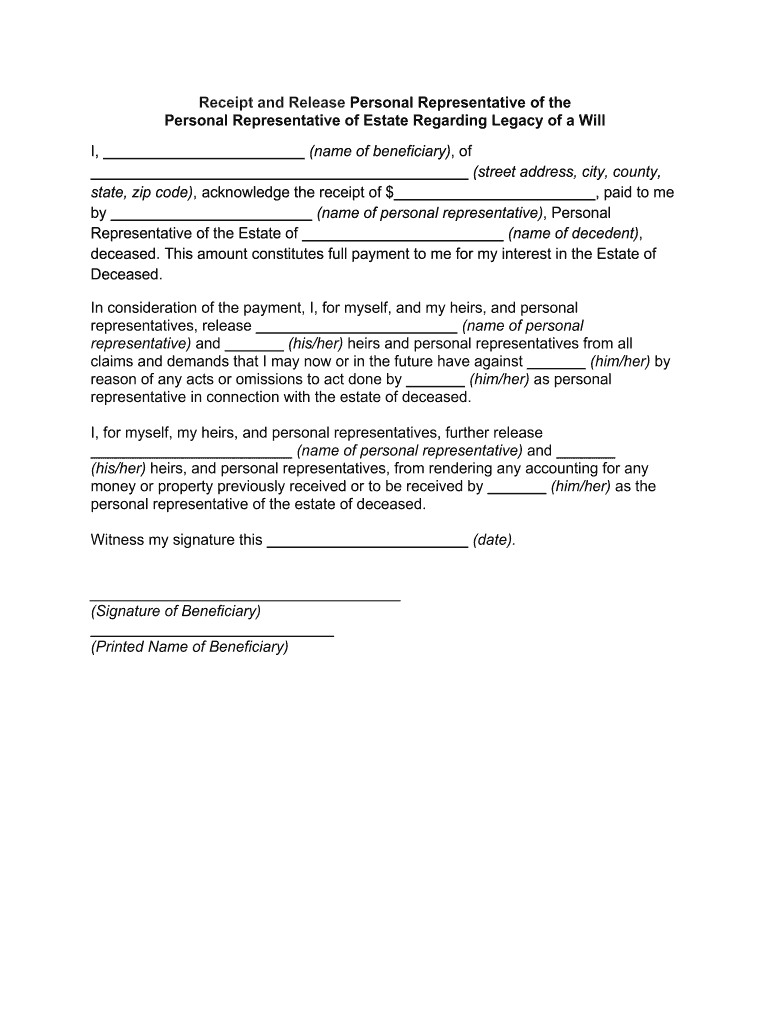

Receipt And Release Form To Beneficiaries Signnow

21 Printable Direct Debit Form Commonwealth Bank Templates Fillable Samples In Pdf Word To Download Pdffiller

Waiver Of Filing Requirements 364es Pdf Fpdf Doc Docx South Carolina

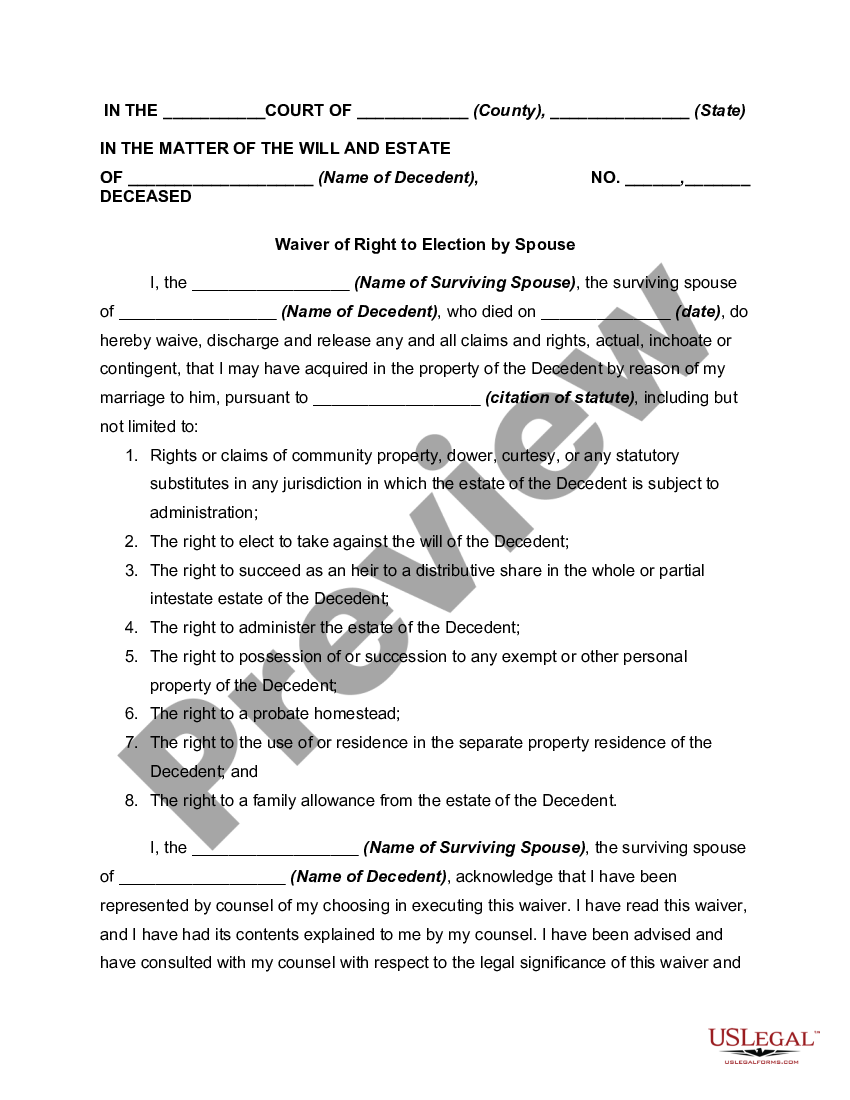

Spousal Waiver Form Real Estate

Waiver Of Statutory Requirements And Beneficiary Receipt Release 365es Pdf Fpdf Docx

Waiver Of Rights To Claim Death Benefits Fill Online Printable Fillable Blank Pdffiller

Colorado Renunciation And Disclaimer Of Property From Will By Testate Sample Letter Of Disclaimer Of Inheritance

Looking For A Nj Tax Forms And Templates Download It For Free